Regulation, EMIR-REFIT

EMIR-REFIT: latest update

The new EMIR Refit regulation will come into effect on April 29, 2024, entailing an update to the current EMIR regulation.

Before detailing the most relevant changes to be made in the new EMIR Refit, and how entities will need to prepare for these modifications, it is important to explain what the EMIR regulation is, when it was introduced, and its purpose.

What is EMIR regulation?

The European Market Infrastructure Regulation, also known as EMIR, is the European regulation that governs the trading and registration of derivatives transactions, which came into force on August 16, 2012.

As the CNMV (Spanish National Securities Market Commission) points out, EMIR establishes a series of obligations for all investors who trade derivatives contracts, whether they are financial or non-financial entities.

This Regulation aims to provide a regulatory framework for derivatives trading to offer greater security and transparency.

What are the main changes in the new EMIR - REFIT regulation?

The modifications to this regulation entail some very important changes:

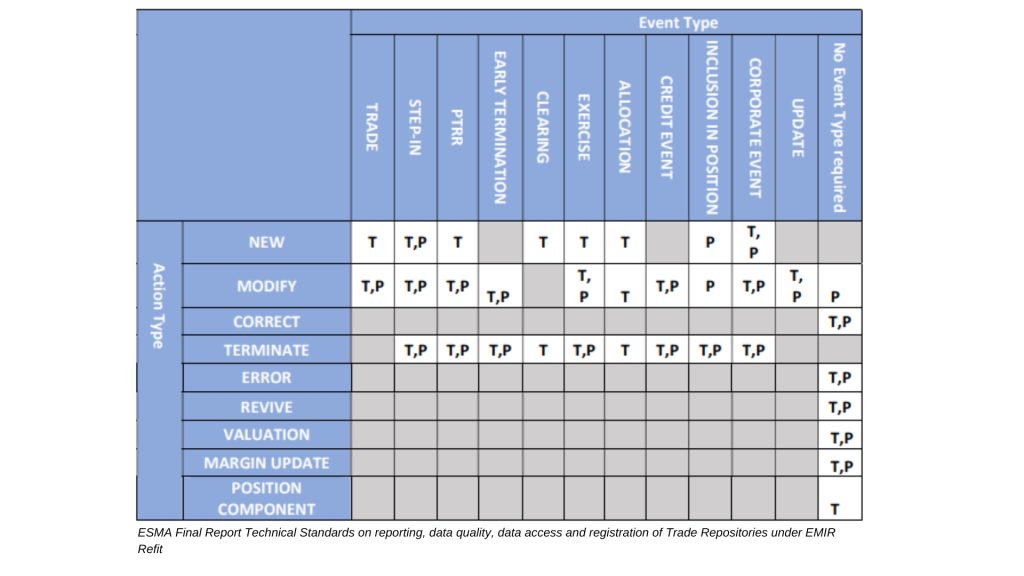

– A new “Event Type” field and its combination with the “Action Type” field. A table showing the combination of the aforementioned fields is attached below.

The prevention of money laundering and terrorist financing will remain a top priority in 2025.

Among the planned measures are the updating of the European Banking Authority’s (EBA) guidelines and a review of the Central Register of Beneficial Ownership, with the aim of facilitating access to information on the beneficial owners of legal entities.

– Change of reporting format from CSV to XML: this update achieves global standardization, eliminating the risk of data discrepancies.

– Information on guarantees and valuations has been updated with additional calculations.

– Financial counterparties (FCs) are now solely responsible for reporting on behalf of non-financial counterparties (NFCs). Therefore, NFCs are now obligated to provide accurate data to their financial counterparty in the transaction.

– The new UPI (Unique Product Identifier) and UTI (Unique Transaction Identifier) codes: While the main function of the UPI is to facilitate the identification of financial derivatives, the UTI aims to eliminate the risk of duplicate transactions.

– More information fields are added: The number of fields increases from 129 to 203.

Furthermore, according to BME, all derivative products (Financial, Energy, FX, xRolling Equities, and Digital Assets) will be reported at both the transaction and position levels, with the objective of reflecting the actual exposure between counterparties.

Internal Revenue Securities (IRS) products will be reported only at the transaction level, in accordance with the lifecycle rules applicable to transaction reporting.

What is the UPI code?

The UPI code, Unique Product Identifier, is the code that identifies the financial derivatives established by the new regulations. This code aims to facilitate data sharing, helping the relevant authorities to detect potential risks and failures in the derivatives market.

The DBS, Derivatives Service Bureau, has been designated as the future provider of the UPI system.

What is the UTI?

The UTI, Unique Transaction Identifier, serves to identify individual transactions to eliminate the risk of duplicate transactions. It must be unique throughout its entire lifecycle and cannot be reused.

Finally, the UTI must consist solely of alphanumeric characters, comprising the LEI (Legal Entity Identifier, used to identify the legal entities involved in financial transactions) of the entity generating the UTI, and a unique code also created by that entity.

How can we help you?

At Arena Financial Tech, we can help you manage the processes required to meet the new objectives and challenges set by the new EMIR-REFIT regulations, which will come into effect on April 29, 2024. We also offer our own solution to help you comply with REGIS-TR requirements, automating the communication of transactions to the regulator and ensuring accurate, timely, and high-quality reporting.