KeyProcesses, SettlementCycles

T+1 and the path to instant settlement

Settlement cycles are undergoing an unprecedented transformation: in 2024, seven markets representing a total capitalization of $59 trillion have reduced their settlement time by 83%. This fundamental shift toward T+1 settlement cycles marks the beginning of a new era in global financial markets.

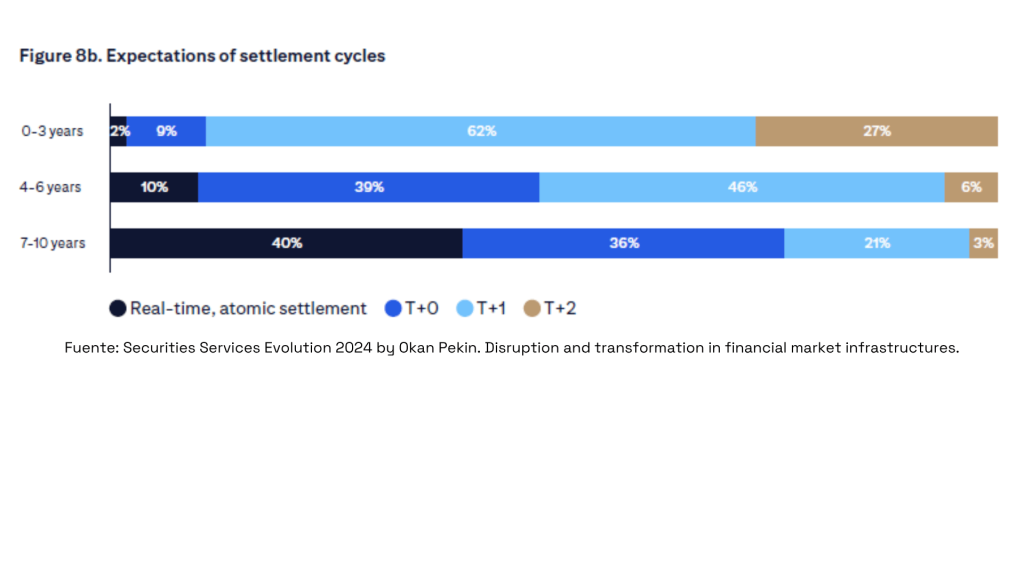

Moreover, 94% of global market participants expect to implement T+1 or faster settlement cycles in their markets within the next five years.

We are, therefore, at a crucial moment in the evolution of financial settlement cycles, where technology and operational efficiency are converging to create a future in which instant settlement could become the new global standard.

Below, we outline the operational benefits, technical challenges, and key process impacts of the T+1 settlement cycle. We also explore the expected timeline for global adoption, projecting settlement evolution over the next 0 to 10 years.

Key Operational Benefits of T+1

The transition to T+1 is already producing tangible results in financial markets. A shorter settlement cycle provides significant opportunities for greater automation, standardization, and efficiency.

• 30% Reduction in Clearing Margins

Implementing T+1 significantly lowers margin requirements for both buyers and sellers. This reduction frees up capital for market participants, minimizes exposure, and contributes to a more efficient trading environment.

• Optimized Capital and Liquidity

The T+1 cycle substantially enhances market liquidity by making funds more readily available to participants. This enables managers to adjust positions more frequently and make tactical changes to optimize portfolio performance.

• Lower Counterparty Risk

Financial institutions can minimize the time they are exposed to open positions and reduce market risk. T+1 settlement also mitigates systemic financial risk by:

Reducing procyclical margin and liquidity challenges, which can amplify financial instability during periods of volatility.

Decreasing credit and operational risk exposure.

Accelerating transaction settlement, ensuring trades are finalized as quickly as possible.

This transition to shorter cycles allows market participants to better manage volatility risk and respond faster to asset price fluctuations.

Ultimately, these trends contribute to a more inclusive and efficient financial ecosystem, where every challenge represents an opportunity for innovation and progress.

Waht are they Technical Challenges of the Transition?

The shift to T+1 involves multiple technical and operational challenges that require innovative solutions. Market participants must undergo significant transformations in their post-trade systems and workflows.

• Post-Trade Process Automation

Manual trade confirmation exposes firms to the risks of duplicate entries and operational vulnerabilities.

Therefore, post-trade automation is essential to streamline processes and mitigate operational risks. The lack of transparency in the confirmation process also makes it difficult to proactively identify operational bottlenecks.

• Managing Global Time Zone Differences

The impact is particularly significant for entities in Europe and Asia, due to time zone differences with the U.S. Key challenges include:

Coordinating meetings and operational deadlines.

Ensuring effective real-time communication.

Implementing location- and time-independent operational processes.

• Technological Infrastructure Requirements

The transition demands a robust infrastructure to ensure business continuity. Adjustments to overnight cycles and consensus on the number and spacing of settlement cycles are also required.

Infrastructure qualification must ensure that facilities meet established specifications and operate within recommended limits. With the adoption of Cloud Computing and Artificial Intelligence (AI), these requirements become even more critical to guarantee optimal quality and security standards.

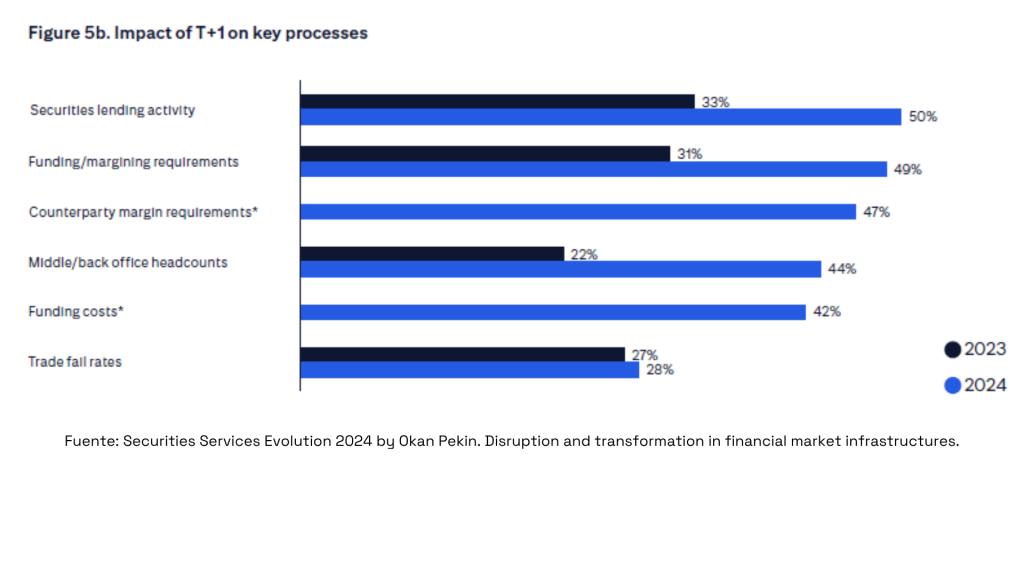

Measuring the Impact on Key Market Processes

The implementation of T+1 settlement can significantly affect several core processes within financial markets:

Securities lending settlements will be accelerated, improving efficiency and reducing risks. This will drive substantial growth by allowing greater agility in position management and enhancing liquidity.

Funding and margin requirements will become tighter as settlement times shorten. Institutions will need to manage collateral and margin obligations more quickly, potentially increasing capital demand but also improving risk management efficiency.

Counterparty exposure time will be reduced, leading to adjustments in margin requirements. Institutions will need to recalculate margins more frequently—enhancing efficiency but requiring faster collateral management.

Expectations and Foundational Pillars of Future Settlement Cycles

The evolution from T+2 toward instant or atomic settlement reflects a gradual acceleration toward greater efficiency, security, and transparency. The key pillars of this transformation include:

Automated trade flows, which accelerate transaction execution while eliminating manual processing and human error.

APIs, enabling seamless synchronization and communication across systems and platforms.

Artificial Intelligence (AI), optimizing data analysis and decision-making.

Distributed Ledger Technology (DLT), providing a secure, transparent, and immutable record of all transactions.

However, the true revolution may come with atomic (instant) settlement, where transaction execution and settlement occur simultaneously. This guarantees that both parties fulfill their obligations instantly—eliminating counterparty risk and maximizing efficiency.

ARENA and the Evolution Toward Instant Settlement with AI and DLT

Financial settlement systems are evolving toward a more efficient and digitalized future. The global transition to T+1 marks a significant turning point, with the 30% reduction in clearing margins serving as tangible proof of its benefits.

Indeed, technical challenges such as post-trade automation and global time zone coordination demand innovative, technology-driven solutions.

As global financial markets continue to evolve, trade automation, AI, and DLT are paving the way toward instant settlement—a transformation that promises to redefine operational efficiency and risk management, setting new standards for the future of global finance.