Products

Real Time Balance Control

Intelligent management and regulatory compliance of intraday liquidity

Intraday liquidity management is today one of the biggest challenges for financial institutions. ARENA’s Real Time Balance Control (RTBC) solution enables you to anticipate, monitor, and comply with Basel requirements in real time, using a fully automated and scalable platform.

Simplified regulatory compliance

RTBC allows you to continuously comply with current standards, including auditable reports, full traceability, and an intuitive interface.

BCBS 248

Basel Committee on Banking Supervision recommendations

ILAAP (CRD IV/V)

Processes that require assessing intraday liquidity usage, associated risks, and governance.

Efficiency, control, and resilience in the face of real-world challenges

Currently, many financial institutions manage intraday liquidity through limited, manual, and estimation-based processes. ARENA’s RTBC solution offers a structured and automated approach that will be a game-changer for your institution.

Your Current Experience

Limited visibility

Intraday liquidity and higher counterparty risk

Intraday financing

Excessive/artificial, with associated costs and no visibility over incoming payments.

Intensive reconciliation

Resource-intensive, with no clear reference between payments and underlying transactions.

Risk of non-compliance

In scheduled payments, with no visibility for regulatory reporting.

Real Time Balance Control

Real-time control and visibility

Monitoring of daily limits and key indicators (BCBS 248)

Intraday liquidity optimization

Management of different types of collateral and integration of available credit lines (both granted and received)

Real-time integration

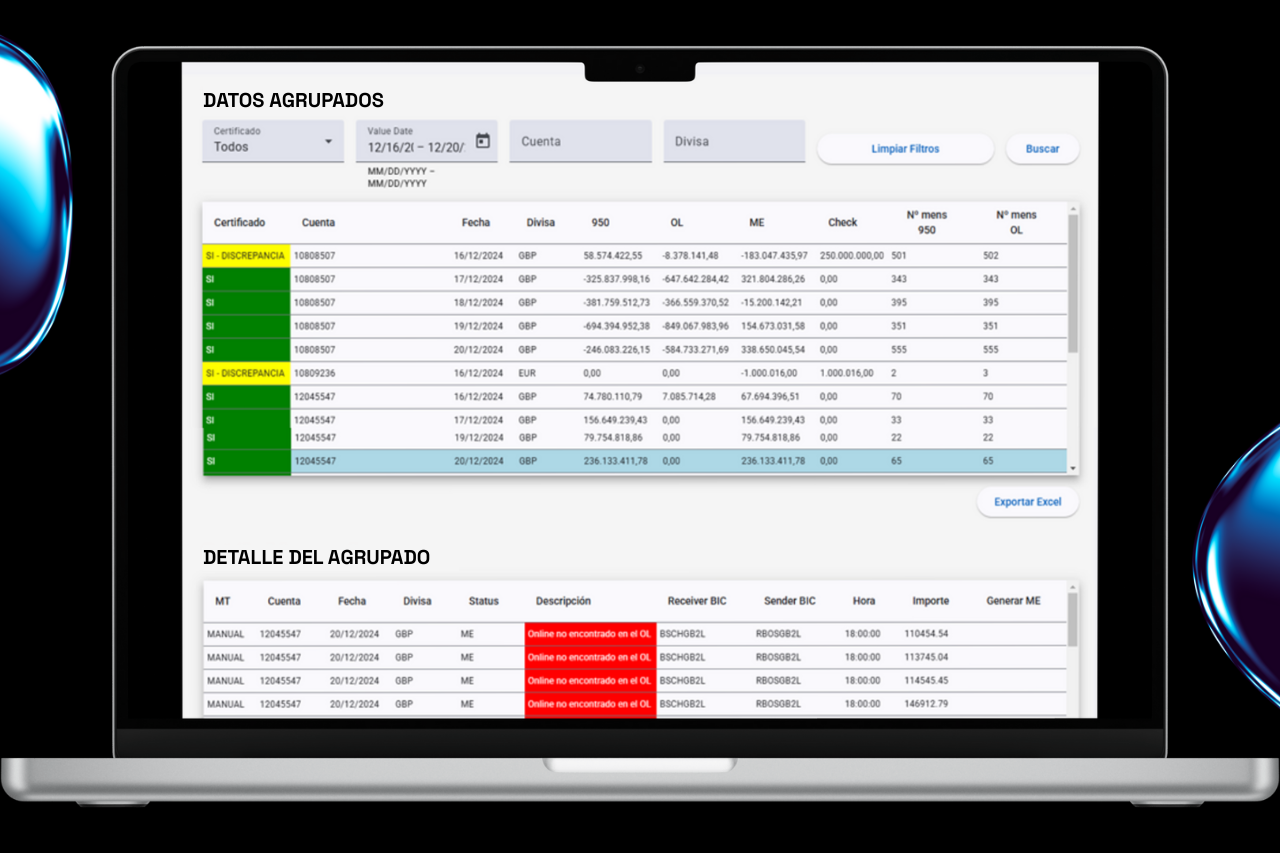

Through reference correlation between message types and automatic reconciliation.

Visibility of critical payments

To meet specific obligations on time.

RTBC Functional Modules

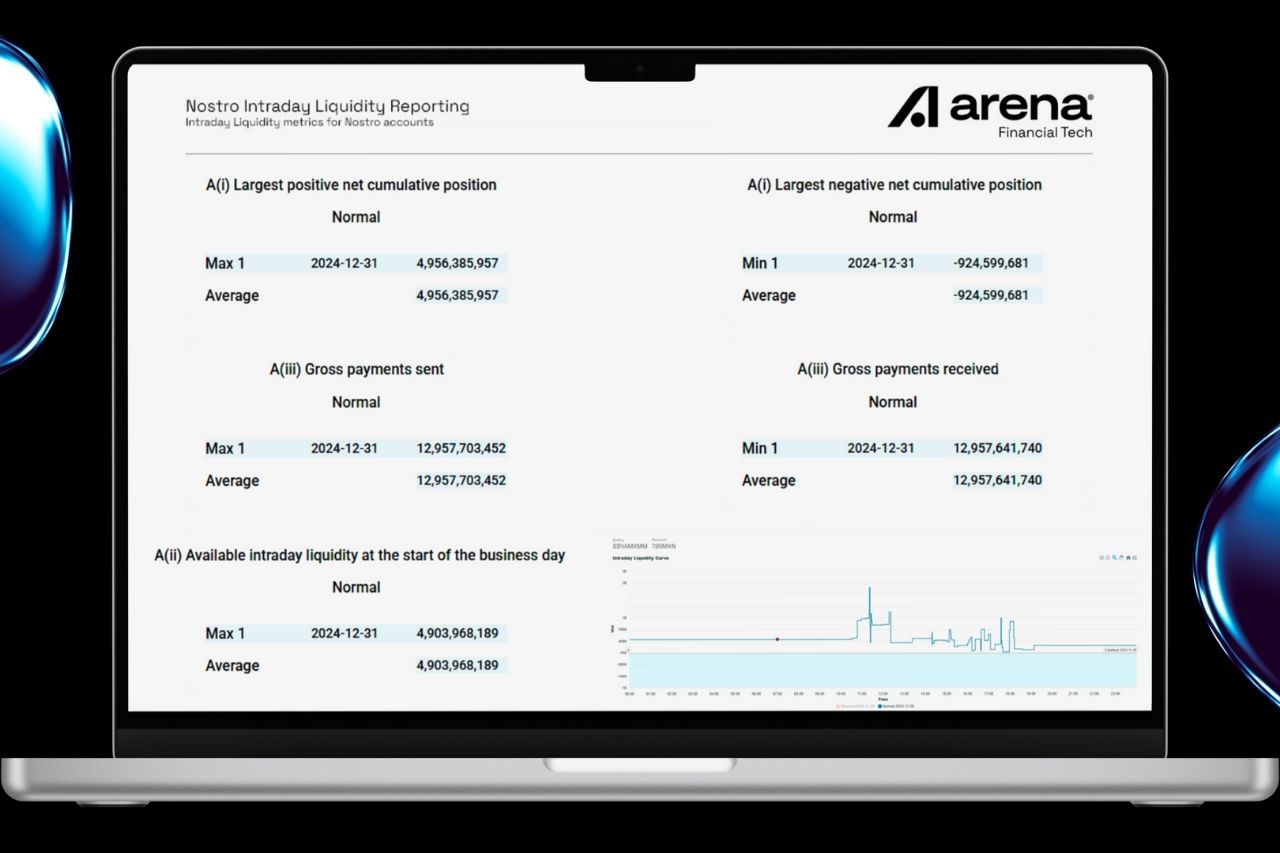

- Calculation of BCBS 248 metrics consolidated by account, counterparty, and date.

-

Generation of regulatory and internal reports in real time.

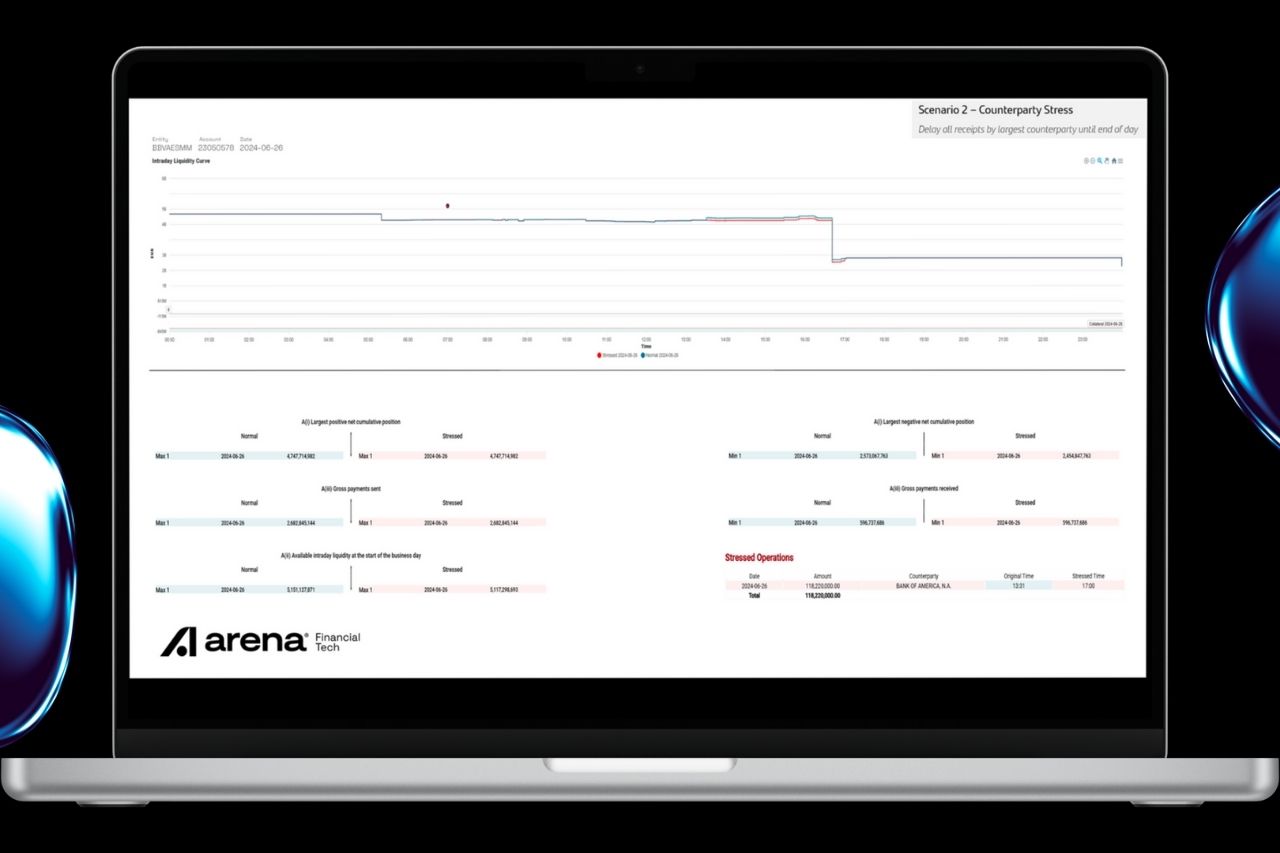

- Simulation of adverse scenarios: delays, counterparty defaults, or market stress.

-

Direct impact on ILAAP, with sensitivity analysis and backtesting.

Integration and Standards

RTBC connects natively with your treasury, risk, core banking, and compliance systems.

Smart Converter: your data integration platform

A solution designed by ARENA Tech to ingest information from SWIFT (MT/MX), APIs, files, and databases, featuring configurable parser, mapper, and builder components that adapt to any operational flow.

Fully compatible with ISO 15022 and ISO 20022. Includes continuous maintenance of new releases, ensuring ongoing compliance and up to date functionality.

Support for SWIFT MT/MX messages and REST APIs

Compliance with cybersecurity standards

Maintenance adapted to regulatory and SWIFT changes

The keys to RTBC’s success

- Continuous regulatory compliance

- Operational risk reduction

- Real-time visibility

- Automatización end to end

- Full traceability and audit support

A solution for today, designed for the future

Born for Basilea, designed to evolve.

Native integration

with financial

messaging.

User-friendly interface

for quick and easy access.

Ready for future regulatory and technological changes

Do you want to learn more about Real Time Balance Control?

We’ve prepared an exclusive document with all the technical and functional information about our solution. Download this whitepaper and explore Real Time Balance Control in depth to see how it can transform your institution.